Cyril Mur • May 31, 2024

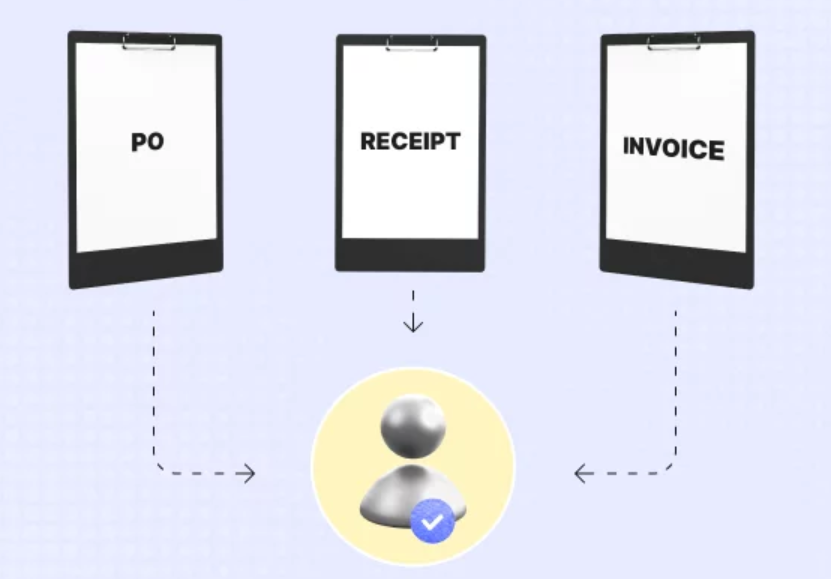

The 3 way matching: a key process to an efficient accounts payable process

Three-way invoice matching is crucial to an efficient purchasing policy for several reasons:

- Enhanced Accuracy: ensures that the details on the purchase order (PO), the receiving report, and the supplier’s invoice match perfectly. This verification minimises errors in quantity, pricing, and product descriptions, which is essential for maintaining accurate financial records and inventory levels.

- Cost Savings: by ensuring that payments are only made for received and correctly billed goods or services, three-way matching helps prevent overpayments, duplicate payments, and payments for undelivered items. This results in significant cost savings for the organisation.

- Fraud Prevention: mitigates the risk of fraud by confirming that all three documents align. This reduces the likelihood of fraudulent invoices being paid, protecting the company’s financial resources and integrity.

- Efficient Discrepancy Resolution: when discrepancies arise between the PO, receiving report, and invoice, they are identified and resolved before payment is processed. This proactive approach minimises payment delays and reduces the administrative burden of resolving issues post-payment.

- Streamlined Approval Process: automates and standardises the approval process. When all three documents match, the system can automatically approve the invoice for payment, reducing the need for manual intervention and speeding up the payment cycle.

- Supplier Relationship Management: timely and accurate payments foster better relationships with suppliers. Reliable payments improve supplier trust and cooperation, which can lead to better service, more favourable terms, and potentially lower prices.

- Regulatory Compliance and Audit Readiness: ensures compliance with internal policies and external regulations by maintaining a clear audit trail of procurement transactions. This audit readiness is crucial for internal reviews and external audits, ensuring that the purchasing process adheres to financial regulations and standards.

- Improved Financial Control: provides better control over the company's expenditures by ensuring that all payments are authorised and justified. This level of control helps in budgeting and financial planning, contributing to the overall financial health of the organisation.

- Operational Efficiency: reduces manual processing and administrative tasks associated with verifying and approving invoices. This efficiency allows accounts payable staff to focus on higher-value tasks, improving overall productivity within the finance department.

- Data-Driven Decision Making: collects accurate and consistent data on purchasing and payments, which can be analysed to inform strategic decisions. Insights gained from this data can lead to improved purchasing strategies, better inventory management, and more effective negotiation with suppliers.

In summary, three-way invoice matching is a foundational element of an efficient purchasing policy, enhancing accuracy, cost control, fraud prevention, supplier relationships, and overall financial management. This process not only ensures that payments are accurate and justified but also supports the broader goals of operational efficiency and strategic decision-making within the organisation.